Mining Bitcoin at Human Scale

Setting up a Bitaxe, on purpose

Bitcoin mining usually appears in one of two forms. At one end, it is an abstract process hidden behind charts, hashrate graphs, and network difficulty numbers that update every few minutes. At the other, it is an industrial activity, taking place in vast warehouses filled with specialised machines drawing megawatts of power.

The Bitaxe sits deliberately outside both of those worlds.

It is not profitable in any meaningful sense. It does not compete with industrial miners. It will almost certainly never find a block on its own. And yet, setting one up is one of the clearest ways I have found to understand what Bitcoin mining actually is, not in theory, but in practice.

This post documents that process. What the miner is, what it does, how it is set up, and why it is still worth doing even when the numbers make no sense.

Why a Bitaxe at all?

If the goal is to earn Bitcoin, a Bitaxe is the wrong tool. Buying Bitcoin directly is cheaper, simpler, and vastly more efficient. Even modest industrial ASICs outperform it by several orders of magnitude.

That is not a flaw. It is the point.

The appeal of the Bitaxe is not return on investment. It is visibility. It takes something that usually exists at an incomprehensible scale and reduces it to something you can hold in your hand, power from a wall socket, and monitor in real time from a web browser.

This is Bitcoin mining without the mythology. No passive income promises. No greenwashing. No motivational slogans. Just computation, electricity, probability, and time.

What the Bitaxe actually is

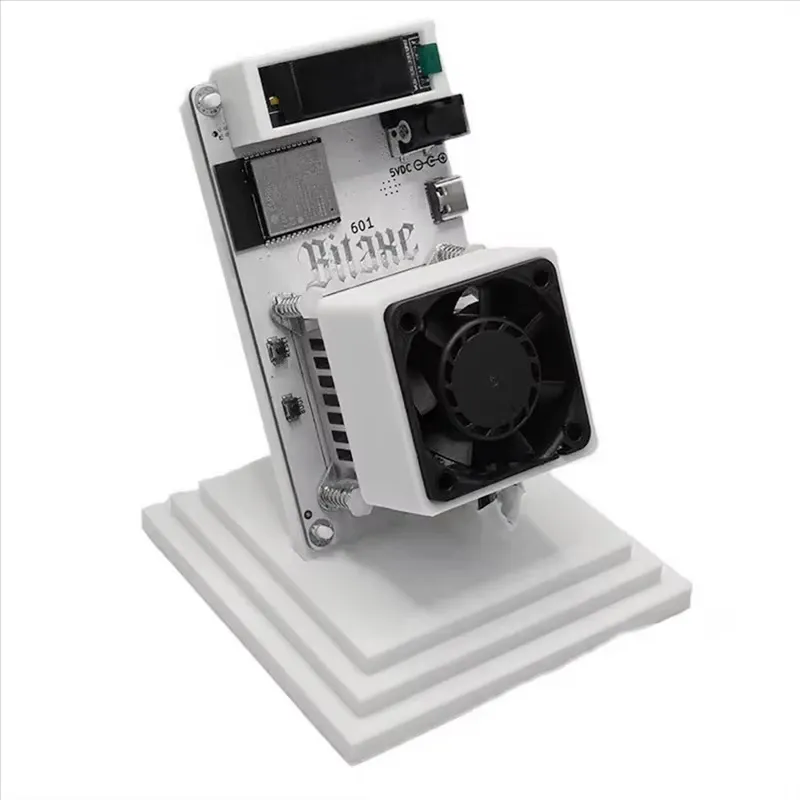

The Bitaxe is a single chip Bitcoin ASIC miner built around open source hardware and firmware. It is designed to be inspectable, modifiable, and understandable.

It is important to be clear about what it is not.

It is not a GPU miner. GPUs have not been viable for Bitcoin mining for over a decade.

It is not cloud mining. Nothing about this is abstracted away.

It is not a toy, even if it looks small.

What it is, is a deliberately constrained Bitcoin miner. One ASIC chip, modest power draw, simple cooling, and a controller that exposes nearly everything the device is doing.

In the broader mining ecosystem, the Bitaxe occupies a niche that industrial hardware abandoned long ago. It is small enough to be educational, slow enough to be observable, and simple enough to invite experimentation.

What is inside the box

Despite its size, the Bitaxe contains all the core components of a modern Bitcoin miner.

The ASIC

At the heart of the device is a dedicated Bitcoin ASIC chip. ASIC stands for Application Specific Integrated Circuit. This chip does one thing, and one thing only: it computes SHA-256 hashes as efficiently as possible.

Bitcoin mining does not involve solving puzzles or performing clever calculations. It involves generating vast numbers of hashes and checking whether any of them meet the current network difficulty target. The ASIC exists to do this faster and more efficiently than any general-purpose processor ever could.

Even a single chip can perform trillions of hashes per second.

The controller

The ASIC does not operate in isolation. An ESP32 microcontroller handles everything around it. Networking, configuration, telemetry, and the web interface all live here.

This separation is important. The ASIC hashes. The controller thinks.

It connects the miner to your Wi-Fi network, talks to the mining pool, displays statistics, and allows you to tune parameters like frequency and voltage.

Cooling

Even at low wattage, mining produces heat. The Bitaxe uses a small heatsink and fan mounted directly to the ASIC.

Thermals matter more than people expect. A stable temperature is not just about protecting the hardware. It directly affects error rates and long-term reliability. One of the benefits of a small miner is that you can actually observe this relationship in real time.

Power

The included power supply is rated at around 25 watts. To put that in perspective, that is roughly comparable to a home router or a small LED desk lamp.

This low power draw is what makes the Bitaxe viable as a household device. It can run continuously without tripping circuits, generating excessive heat, or producing noticeable noise.

What the miner is actually doing

Bitcoin mining is often described in mystical terms. In reality, it is brutally simple.

The miner receives a block template from the network. This template includes a set of transactions and some metadata. The miner then repeatedly modifies a small value called a nonce and hashes the resulting block header.

Each hash produces a 256-bit number. If that number is below the current difficulty target, the block is valid.

Most hashes are useless. Almost all of them, in fact.

Mining is not about finding the right answer. It is about trying answers fast enough that, statistically, you might get lucky.

Your Bitaxe is performing this process continuously. Billions or trillions of attempts per second, depending on configuration, all of which are discarded except the ones that prove useful work to the pool.

On its own, the chance of a Bitaxe finding a full Bitcoin block is vanishingly small. At current network difficulty, it would take longer than a human lifetime, on average.

This is why mining pools exist.

Solo mining versus pool mining

Solo mining is conceptually pure. You run a miner, you find a block, you receive the entire reward.

It is also statistically absurd at small scales.

Mining pools exist to smooth out variance. Instead of one miner waiting decades for a payout, thousands of miners contribute work and share rewards proportionally.

The Bitaxe supports both modes. Technically, you can solo mine. Practically, pool mining is the only option that produces observable results.

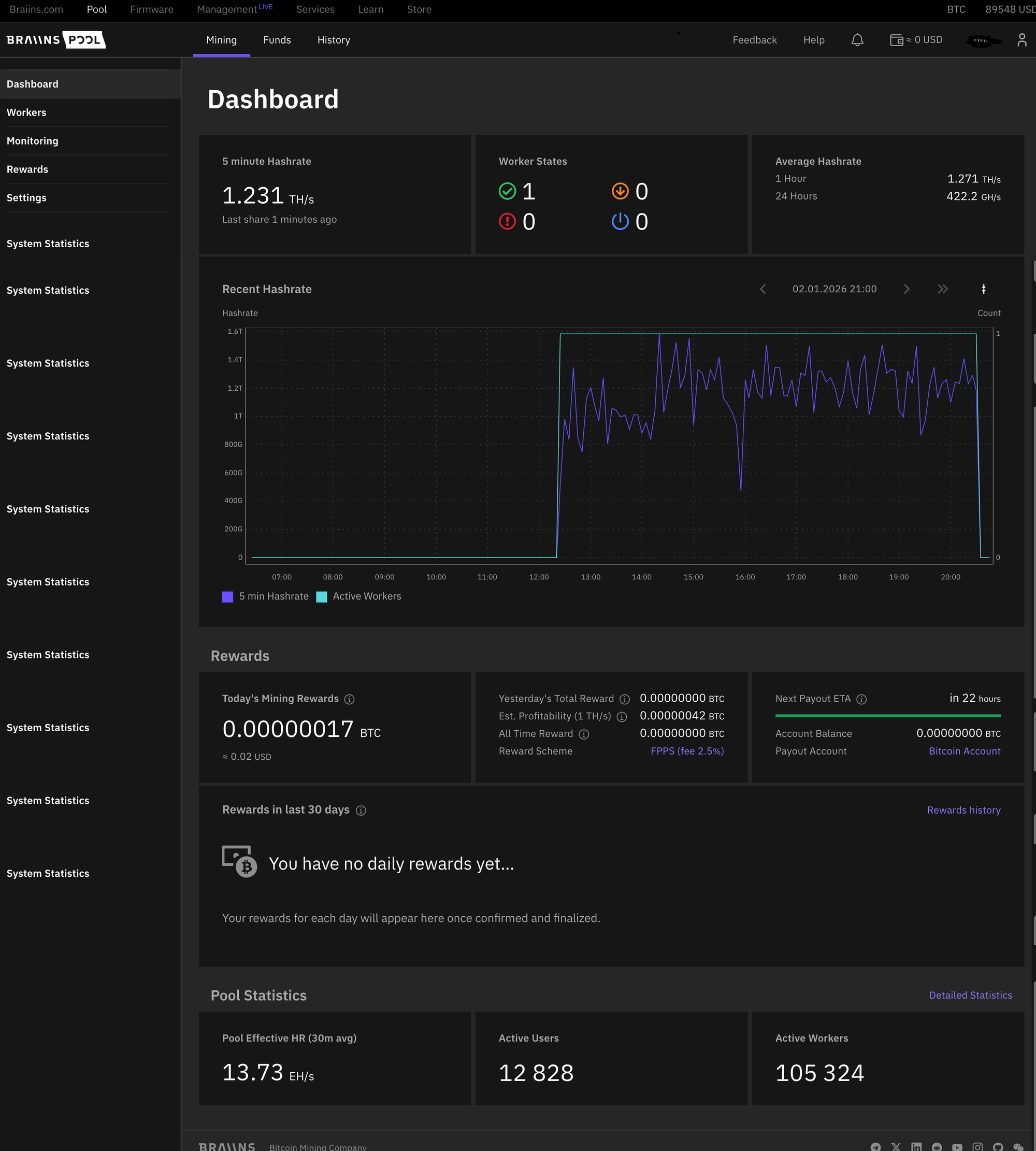

For this setup, I chose Braiins Pool. Not because it pays more, but because it is transparent, well documented, and supports Lightning payouts. At this scale, usability matters more than theoretical efficiency.

First boot and AxeOS

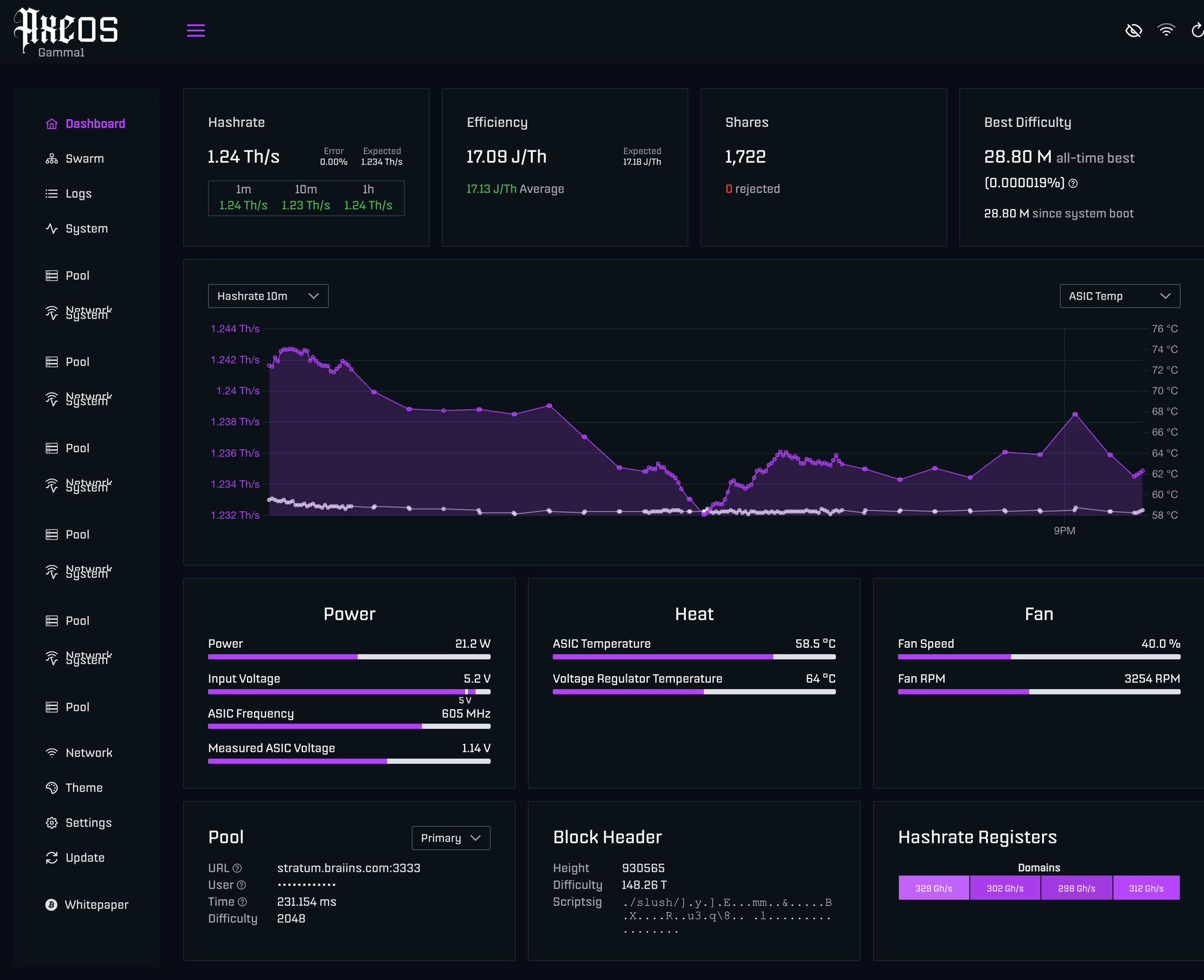

The Bitaxe runs AxeOS, a lightweight, web-based operating system designed specifically for these devices.

Initial setup is straightforward. Power the device, connect to its temporary access point, configure Wi-Fi, and point your browser at its local IP address.

The web interface exposes everything that matters.

Hashrate, both current and average.

ASIC temperature.

Power draw.

Accepted and rejected shares.

Uptime and stability metrics.

One of the most useful aspects of AxeOS is what it does not hide. There is no abstraction layer smoothing over rough edges. If the miner is unstable, you will see it immediately.

Understanding the metrics

At this scale, not all metrics are equally important.

Hashrate is interesting, but not critical. A small increase or decrease does not meaningfully change outcomes.

Temperature matters. Sustained high temperatures correlate strongly with instability and errors.

Reject rate is more interesting than it looks. A high reject rate often indicates marginal silicon quality or overly aggressive tuning. It is one of the few ways you can infer the quality of the ASIC you received.

Power draw matters mostly in relation to the power supply. Staying within its limits keeps everything predictable and safe.

Lightning payouts at tiny scale

One of the most satisfying aspects of this setup is Lightning payouts.

Traditional on-chain Bitcoin transactions are ill-suited to extremely small amounts. Fees quickly dominate the value transferred. Lightning changes that dynamic.

With Lightning payouts, it becomes viable to receive payments measured in single-digit satoshis. This transforms mining from an abstract future promise into something tangible.

Watching sats trickle into a wallet every few hours does not make you rich. It does, however, make the system feel real.

Tuning, overclocking, and restraint

The Bitaxe allows frequency and voltage adjustments. This is where things get interesting, and dangerous.

Increasing frequency increases hashrate, but also power draw and heat. Increasing voltage can stabilise higher frequencies, but pushes the ASIC harder.

More is not always better.

An unstable miner that produces errors or rejections is worse than a slower, stable one. At this scale, the goal is not maximum output. It is sustained, predictable operation.

The included power supply imposes a natural ceiling. Pushing beyond it introduces unnecessary risk for negligible gain.

Tuning the Bitaxe becomes an exercise in balance rather than optimisation.

The economics, briefly

At roughly one to two terahashes per second, annual earnings are tiny. Electricity costs in Australia easily exceed any Bitcoin mined.

This is not a criticism. It is a reality check.

The Bitaxe is not an investment vehicle. Treating it as one misses the point entirely.

Why this is still worth doing

Bitcoin is often discussed as software. Mining reminds you that it is also physical.

Electricity flows. Heat dissipates. Probability asserts itself relentlessly.

Running a Bitaxe makes those forces visible. It reconnects digital abstraction to physical reality in a way few other Bitcoin activities do.

At human scale, mining stops being about profit and starts being about understanding. And for that alone, it is worth the time, the tinkering, and the tiny stream of sats that slowly, patiently, accumulate.